Assume you’re a sales manager for a mid-sized enterprise. You’ve just received a call from your chief revenue officer who wants to know how much revenue you expect your team to produce between now and the end of the year.

You pull up your spreadsheet and start reviewing the numbers, but the forecast just doesn’t look right. Sales have been consistent, but there are so many variables at play and it’s hard to predict what the future holds. Market conditions are volatile, sales cycles are getting longer, and your team is experiencing turnover. To make matters worse, the data you’re working with is incomplete and outdated.

You're feeling the pressure to get it right but you’re not confident you can.

Sound familiar? If so, you're not alone. Sales forecasting and pipeline management are challenging tasks that require consistency, effort, and expertise.

Sales managers must be able to forecast revenue with confidence. Yet, often, forecasts are filled with too much guesswork and not enough rigor.

Forecasting and Pipeline Management

- Why Sales Forecasting and Pipeline Management are Important

- What Are the Different Types of Sales Forecasting?

- Sales Forecasting and Pipeline Management Challenges

- How Do You Accurately Forecast Sales?

- How to Stress Test a Sales Pipeline

- 9 Questions to Stress-Test an Opportunity

- 12 Tips to Keep Your Sales Pipeline Stress-Test Meetings on Track

Why Sales Forecasting and Pipeline Management Are Important

You need to be confident in your forecasting abilities, and you need to know where your team stands at any given time compared to sales targets, if you want to adjust sales strategies as needed to get back on track when you’re behind or extend gains when you find something is going well.

The three primary reasons why forecasting and pipeline management are important are:

- Planning: Company growth plans, spending plans, inventory purchases, and investment plans are often decided based on revenue estimates, which largely roll up from sales manager forecast reports.

- Targeting: Company owners and stockholders typically hold executive leaders accountable for reaching revenue targets, and these leaders similarly hold sales managers accountable.

- Agility: For sales managers specifically, if you don’t know where your sellers’ pipelines are, and you fall behind, you can’t adjust during the year to change plans and influence seller activities to get back on track.

What Is Sales Forecasting?

Sales Forecasting Defined: Forecasting is the process of estimating future revenue in a given time period by predicting the sales revenue from your team.

What Is Sales Pipeline Management?

Sales Pipeline Management Defined: Sales pipeline management is a way to track opportunities that are actively in the process of considering buying.

Top-Performing Sales Managers are 52% more likely to excel at planning and analyzing how sellers should manage their pipelines, according to a study conducted by the RAIN Group Center for Sales Research. When sales managers do this, they can more accurately forecast for themselves and their team.

In our Top-Performing Sales Manager model, which identifies the core roles that sales managers need to perform, Performance Management is next to Pipeline and Forecasting. This is deliberate as they go hand-in-hand. When sales managers have a sense of how strong a seller’s pipeline is, and they’re confident in how much each seller on their team is likely to sell, they can manage seller performance and adjust actions accordingly based on whether the seller is behind or ahead of target.

What Are the Different Types of Sales Forecasting?

Pipelines and forecasts are typically looked at over the course of quarters or a year. It’s up to sales managers to estimate the revenue that will materialize from various sources.

|

Source of Revenue |

Sales Manager Action |

|

Existing pipelines of sellers |

Stress-test the new business pipelines to predict actual sales with maximum confidence. |

|

Sellers’ account renewals, repeat business, and account growth |

Analyze and estimate new business that might come from accounts in the form of renewals, repeat business, or growth. |

|

Future additions to the pipeline from new leads: seller-generated, inbound, referral-based, or other sources |

Estimate revenue based on new opportunities that have not yet entered the pipeline but need to materialize to achieve sales target. |

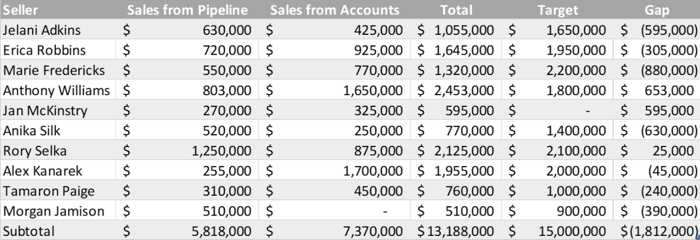

A simple pipeline analysis might look something like this:

Imagine you have 10 sellers on the team. You’ve analyzed their existing pipelines and are confident in the likely sales that will result from current opportunities. The sellers in this example have existing accounts, and you estimate with each seller what the sales from those accounts will be. Together, you have a sales total based on information you know and can estimate based on your strong pipeline stress testing and account planning.

Now, let’s say you know each seller’s target sales for the year. This will give you a gap, which is the number of sales you likely need to generate from new sources, like seller prospecting, inbound leads, referrals, or some other source.

The question is, how do you arrive at this forecast with as much confidence as is possible?

This is what we’ll cover in the remainder of this article.

Sales Forecasting and Pipeline Management Challenges

As noted previously, sales forecasting is not without its challenges, including:

- Data accuracy: Sales forecasting is only as accurate as the underlying data. Sales managers may collect and analyze data from various sources, including historical sales data, market trends, customer behavior, and economic indicators.

However, this data can be incomplete, inconsistent, or outdated, leading to inaccurate forecasts. For example, sometimes sellers or others involved in the process have personal agendas and styles that can lead to sandbagging: under-estimating likely incoming sales so they can seem to come out ahead, or over-estimating incoming sales, which can leave sales managers far behind when these sales don’t materialize, especially if the managers find out too late.

- Market volatility: Sales managers must contend with constantly changing market conditions, such as changes in customer demand, competitor activity, or economic fluctuations, making it difficult to accurately predict future sales.

- People factors: Sales forecasting is also influenced by the actions and decisions of individuals, such as salespeople, buyers, and executives. Changes in leadership, employee turnover, or unexpected buyer behavior can significantly impact sales forecasts.

- Limited resources: Sales managers may face limitations in terms of the resources they have available to conduct forecasting. Limited access to data, technology, or expertise can make it challenging to develop accurate forecasts.

- Resistance to change: Sales managers may encounter resistance to the forecasting process from their team members. Some sellers may view forecasting as a burden or may not fully understand its importance, leading to incomplete or inaccurate data collection.

You need to be aware of the challenges involved in the process so you can address them where possible, and approach your forecasting and pipeline management activities in ways that help you achieve better outcomes and more accurate results.

How Do You Accurately Forecast Sales?

When pipelines aren't reviewed and stress tested on a regular basis by a sales manager, the pipeline can be full of dead wood. In other words, there are too many opportunities in the pipeline that sellers report are active and strong, but are, in fact, unlikely to close, or unlikely to close at the rate opportunities at that pipeline stage typically close.

With manager stress testing, pipelines can be freed of dead wood.

Sometimes sellers don’t overestimate their pipeline because they’re posturing or sandbagging. Instead, they have what we call “happy ears”: they hear some buying signals from a prospect and become too confident too quickly about the opportunity, but they haven’t qualified the opportunity or gotten into enough detail to know how real (or not) the opportunity is.

In other cases, sellers don’t want deals in their pipelines to be thoroughly vetted, or they don’t want their opportunities to seem to close at too low a rate, so they don’t put them into their pipelines at all. When this happens, sales wins will sometimes seem to appear out of thin air, when, in fact, a seller has been working on them for a while but didn’t add them or move them through the CRM. This can make it impossible to manage or forecast.

If, however, you know how to stress test a pipeline and watch out for these patterns and challenges with consistency and rigor, you’ll avoid many of these pipeline management and forecasting pitfalls—and have a consistent and defensible forecast that comes in as accurately as it can.

When you do, it’ll benefit your company, your sellers, and you.

GET THE LATEST SALES TIPS, TOOLS, AND RESOURCES

Subscribe today to get the latest on virtual selling, insight selling, strategic account management, sales conversations, and more straight to your inbox.

How to Stress Test a Sales Pipeline

A sales forecast is the estimate of future revenue in a given time period of your team.

For a forecast to be as accurate as it can be, each seller’s pipeline needs to be accurate.

Sales pipeline management is a way to track opportunities that are actively in the process of considering buying.

For a pipeline to be accurate, sales managers must work with sellers on an ongoing basis to make sure each opportunity in the pipeline is accurately reflected with a best estimate of three major numbers:

- Likely revenue

- Likely date of close

- Percentage likelihood of close

If you want pipelines to be accurate, sales managers must perform pipeline stress tests to arrive at these estimates.

A pipeline stress test is where a sales manager inspects the opportunities in the pipeline to make sure the likely revenue, likely date of close, and percentage likelihood of close are accurate estimates.

The last thing you want is a great-looking pipeline that is, in fact, not real: filled with opportunities unlikely to close at the forecasted rates, unlikely to close at the forecasted amounts, and in the wrong pipeline stages so it's a jumbled, impossible-to-make-sense-of mix.

Reviews and stress tests are how you make sure your pipelines are real.

Pipeline reviews and stress tests are typically 30- to 60-minute meetings between a seller and manager, often conducted every other week or every month, during which each opportunity—or at least the major ones—are inspected.

The 4 steps to conduct a pipeline opportunity review or stress test are:

- Inspect the opportunities by stage gates to make sure they’re in the right place based on seller actions or buyer verifications. A buyer verification is simply confirmation that something is true. For example, that they have expressed need, satisfaction with the solution your seller has crafted, and so on.

- Confirm the most likely revenue size of the initial contract value of the opportunity.

- Confirm the most likely opportunity close date.

- Assign a percentage likelihood of close to each opportunity.

Inspecting Opportunities with the Seller

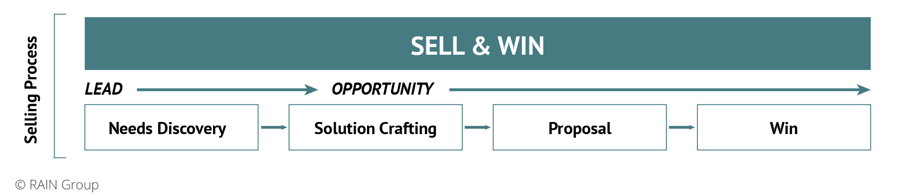

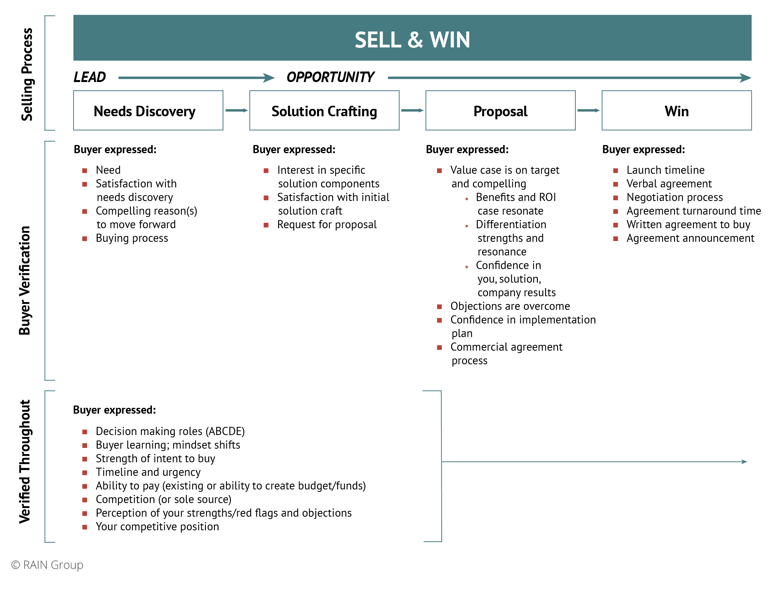

While yours may look a bit different, a typical sales pipeline includes prospecting, needs discovery, solution crafting, proposal, and win.

For pipeline stress testing, we leave off prospecting as it makes sense typically to focus inspection efforts on opportunities that have made it at least to the needs discovery stage.

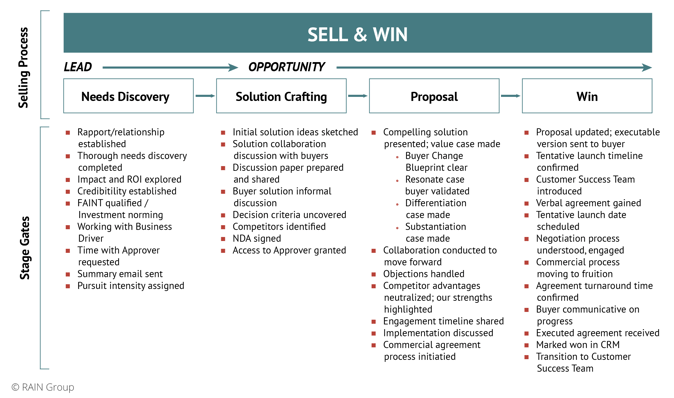

Each stage will have “stage gates,” or items that need to be confirmed before an opportunity can move to the next stage. Every company’s stage gates will be different, but this generic example will give you the idea.

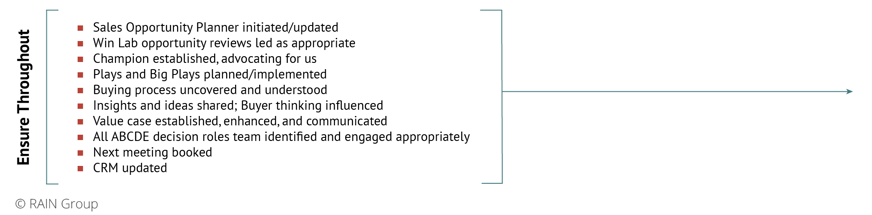

Additionally, there are actions across the opportunity that happen as early as needs discovery, but that can happen later or evolve throughout the selling process. Sellers must confirm and update these as they happen.

Here’s the same pipeline, viewed through the lens of the buyer:

The points here are designed to identify what the seller can confirm, or what the buyer has verified, throughout the opportunity.

We recommend stress testing the pipeline through the lens of the buyer verifications, not the stage gates, but we know that not every sales organization has these, so either the stage gates or the buyer verifications will do. And if you have neither, keep reading for a list of standard opportunity stress test questions to ask.

For the opportunity you’re stress testing, review the stage gates or buyer verifications and ask the seller the status. For example, has the buyer:

- Expressed explicit need?

- Stated a compelling reason to move forward?

- Confirmed satisfaction with your needs discovery?

- Shared their buying process?

You might wonder why we include “satisfaction with needs discovery.” In our research, buyers have told us that when they speak to sellers, they have very mixed reviews of how those first meetings go.

When these meetings go poorly, sellers often don’t realize it. But when the meetings go well, buyers often tell the sellers something like, “I’ve spoken to a few vendors, and this has been a great needs discovery conversation in comparison. You really seem to get what we’re trying to achieve.”

You can imagine, then, if your sellers are unaware of how the buyer perceives those early meetings, you could have many opportunities at the needs discovery stage that stall because the buyer isn’t interested in buying from you. But, again, you just don’t know that.

However, if buyers have expressed satisfaction with early discussions, the opportunity is more likely to progress. The same happens as you move across the sales cycle and meet with the various buyer decision making roles.

If the seller can confirm buyer verifications, the opportunity is probably more real. If not, your pipeline is unlikely to be accurate.

If you have stage gates or buyer verifications at your company, learn what they are, and ask questions about each area to inspect an opportunity.

If you don’t have these, you can create your own. For example, here’s a quick list of nine questions you can ask to stress test an opportunity.

9 Questions to Stress Test an Opportunity

- Do you know the decision makers and have you identified their roles? How is your relationship strength with the most important decision makers?

- Is the opportunity FAINT qualified?

- Has the buyer expressed a compelling reason or intent to buy?

- How strong is our fit, i.e., right products, services, and solutions; right company; cultural and people match; industry experience; geographical coverage, etc.?

- Is the value case strong? Has the buyer verified the value case?

- How strong is our competitive position?

- How engaged is the buyer?

- Are there any red flags that may be working against us, such as competition, postponements, shifting priorities, or buyer team changes?

- Do you have a clear action plan to win?

As you inspect opportunities, you may want to get into more detail about how to win them. If an opportunity is important enough for a deal review—what we call a Win Lab—schedule one for some time soon. If you spend too much time on one opportunity during forecasting conversations, you’ll run out of time to do the cross-pipeline review.

Once you’re done with the stress test of the opportunity, review the most likely contract value and assign a percentage likelihood that the opportunity will close. Some companies use standard percentages of close that correspond to the sales pipeline stages, and others ask sales managers to assign a percentage of close custom for each opportunity. It’s up to you to decide what’s right for you and your company.

Then, update the expected date of close to identify the time period when it’s most likely this opportunity will enter the win column.

And that’s it. Pipeline stress testing may involve several layers, but how to do it is pretty straightforward.

To review, here’s the simple process for stress testing your pipeline:

- Inspect the opportunities by stage gates to make sure they’re in the right place based on seller actions or buyer verifications

- Confirm the most likely revenue size of the initial contract value of the opportunity

- Confirm the most likely opportunity close date

- Assign a percent likelihood of close to each opportunity

Use what your company has for a sales pipeline and reverse engineer the stage gates or buyer verifications into questions, make your own list of questions, or use the 9 questions shared previously if you don’t have any others.

Stress test your sellers’ pipelines on a consistent basis and you'll not only find your forecasts to be as accurate as they can be, but also help your sellers take the actions they need to win more sales.

12 Tips to Keep Your Sales Pipeline Stress-Test Meetings on Track

To keep your pipeline stress test meetings from getting off track, consider these 12 tips:

1. Go from subjective to objective

Without rigor in the process, seller expectations of close are too often based on what they feel about an opportunity. Feelings and hopes are not good predictors of sales wins. Work with your sellers to know that the intent is to get away from subjective assessments of sales opportunities and get closer to objective assessments.

2. Communicate what’s in it for sellers

You need sellers committed to working with you to keep pipelines accurate and up to date. To gain their commitment, make sure they know how this will help them, such as:

- Increasing the likelihood their deals will close by identifying what actions sellers need to take to move sales forward

- Identifying deals that would benefit from deal reviews or Win Labs

- Keeping up with the CRM so it doesn’t become a grind

- Building and strengthening the seller’s reputation with senior management

3. Lead pipeline reviews one-on-one

Team pipeline review meetings don’t work nearly as well as one-on-ones do. In a group setting, sellers can hide, they may posture in meetings as their peers are evaluating them, there’s not enough time to be thorough, and the conversations can get off track.

4. Give the important opportunities the most rigor

Often, a handful of opportunities will make or break a seller’s pipeline. They’re usually the highest dollar value, highest velocity, or latest stage opportunities. Focus on major opportunities first and with the most rigor.

5. Spot check other opportunities

While you may focus on major opportunities first, spot check a handful of other opportunities. These spot checks will go a long way toward keeping the whole pipeline accurate.

6. Think inspection, not prosecution

Sometimes, pipeline reviews can feel like a prosecution to sellers. Meet them where they are and do what you can to help them progress. It’s fair that you should inspect the pipeline and not accept face value or subjective opinions of opportunities.

When sellers get to know the level of rigor you expect, they’ll get used to it and will prepare for it. As you lead the reviews, avoid creating the perception that you’re looking for what they missed and blaming them for it. Stick to what’s most important, but keep it positive so sellers feel like it’s a collaboration not an interrogation, and so they get to know your expectations.

7. Identify opportunities for Win Labbing, but don’t stop to Win Lab

As you inspect opportunities, it’s natural to want to talk in-depth about how to win them. If an opportunity is important enough for a Win Lab, schedule one. If you do deal reviews during the pipeline review, you’ll run out of time to do the cross-pipeline review.

8. Consider swing deals

When forecasting, it’s often a good idea to consider deals that, if they come in, will have an outsize effect on results. Any opportunity that is three times larger than average is likely a swing deal. At RAIN Group, we call these "whales"—big deals that give you false confidence in the strength of your pipeline. We keep these out of the pipeline to ensure we're not hinging our success on one opportunity that can make or break the forecast.

9. Estimate your “push to the right” and “bluebirds”

Imagine it’s the beginning of the quarter and you’re estimating $5 million in new sales wins for the quarter. At the end of the quarter, almost everyone experiences:

- Sales that “push to the right” where the opportunity remains active, but the timeline shifts

- Sales “bluebirds” that you didn’t see coming that come in hot and close fast

When forecasting the pipeline, ask yourself what percentage of deals forecasted for a quarter push to the right. Is it 10%? 20%? Whatever it is, plan for it as an average.

Then consider how many sales happen during a quarter, or whatever time period you’re forecasting for, that come in fast and close during the period. These may be old proposals that went silent and suddenly sign, repeat business that closes fast, or new business that comes in with high urgency. Is that 5%? 10%? 20%?

Whatever it is, plan for it. Subtract your “push to the right” deals and add your “bluebird” deals to arrive at the more accurate number.

10. Move stalled opportunities to a stalled list

Many pipelines are filled with deals that sellers believe are still real, but that have slowed down or gone silent. If you have any of these, it’s often a good idea to move them to a stalled list, out of the pipeline, or back to an earlier stage with a lower percentage of close, as deals that go cold sometimes come in, but often at a lower rate.

If any of these opportunities are in a stalled list, it makes it much easier to view the active pipeline as there’s less noise and dead wood.

In addition, you can review the stalled list with your sellers to come up with a re-engagement action for each opportunity. If there are 10 of these opportunities and your seller tries to engage them in a thoughtful way, you often can move a few of them right back into the active pipeline.

11. Manage posturing

Some sellers sandbag or try to make their pipelines look low in order to seem successful when they outperform their forecast. Others try to posture to make their pipelines look strong and full when, in fact, they aren’t.

To manage this with your sellers, address it directly with them. If you get a sense in your pipeline reviews that they’re doing either of these things, try to bring them to the middle so your forecasts are more accurate and action planning to win opportunities is most impactful.

12. Update your CRM in real time

As a matter of hygiene, update your CRM as you go along during pipeline review meetings. This tends to work much better than asking sellers to update them after, which too often doesn’t happen.

If you or your team want help to strengthen confidence in this area and build sales forecasting and pipeline management capabilities, contact RAIN Group to learn more about our sales management programs.